Meet

Darius Dale

Beyond Stocks and Bonds: Betting on Myself

Prior to founding 42 Macro, Darius Dale was a Managing Director and Partner at one of Wall Street’s leading sell side research firms. Darius was head of the firm’s macro team and the architect of the firm’s economic outlook and investment strategy. His research on macro risk management frameworks is award winning and his advice is sought after within the institutional investment community.

Darius is a frequent on-air contributor to financial media including Bloomberg, CNN Money, CNN Business, Fox Business, Fox News, Negocios TV, Schwab Network, Thoughtful Money, Real Vision, Macro Voices, The Pomp Podcast, Forward Guidance, On the Margin, Monetary Matters, The David Lin Report, and BNN . His analysis has been published on various global platforms including The Wall Street Journal, Barron’s, Yahoo! Finance, Fortune, NewsBTC, and cited in Jim Rickards book, The New Great Depression: Winners and Losers in a Post-Pandemic World.

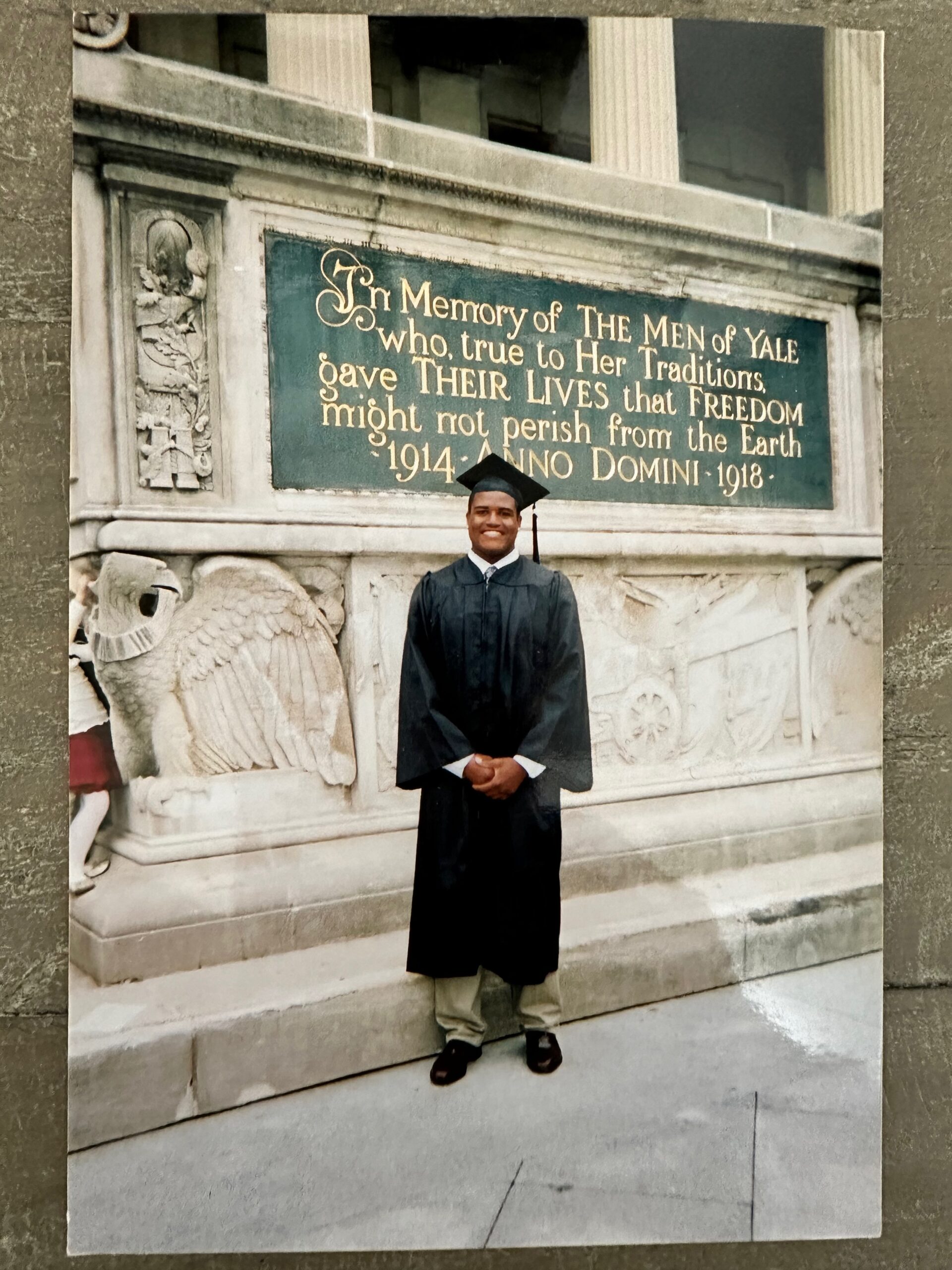

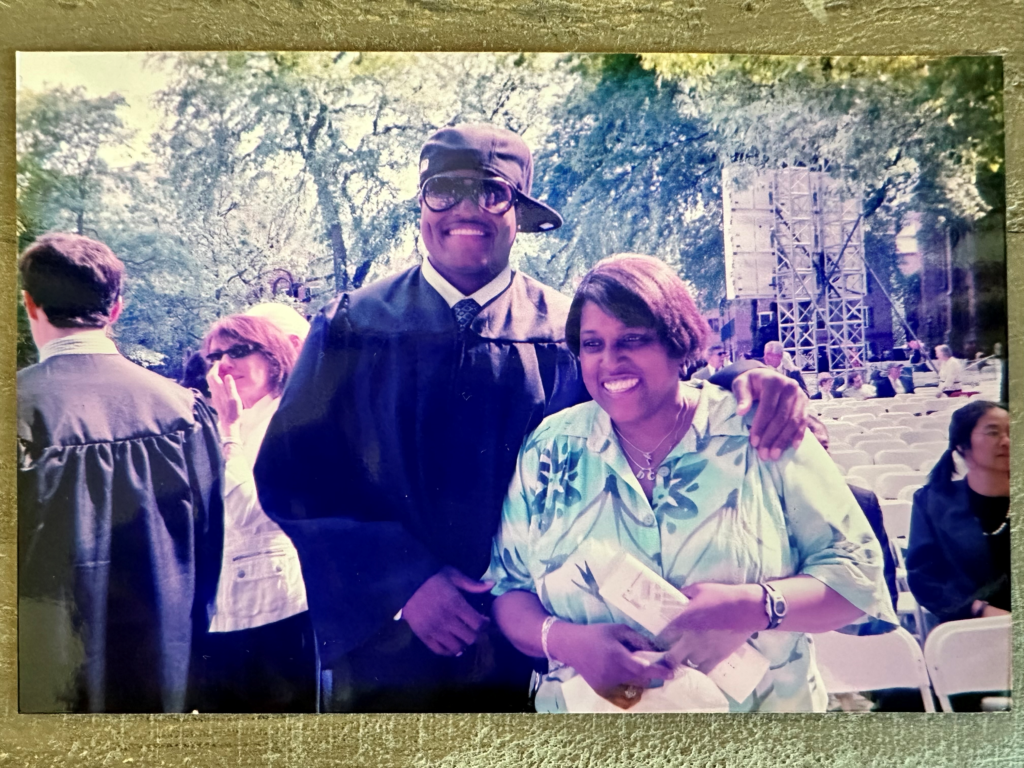

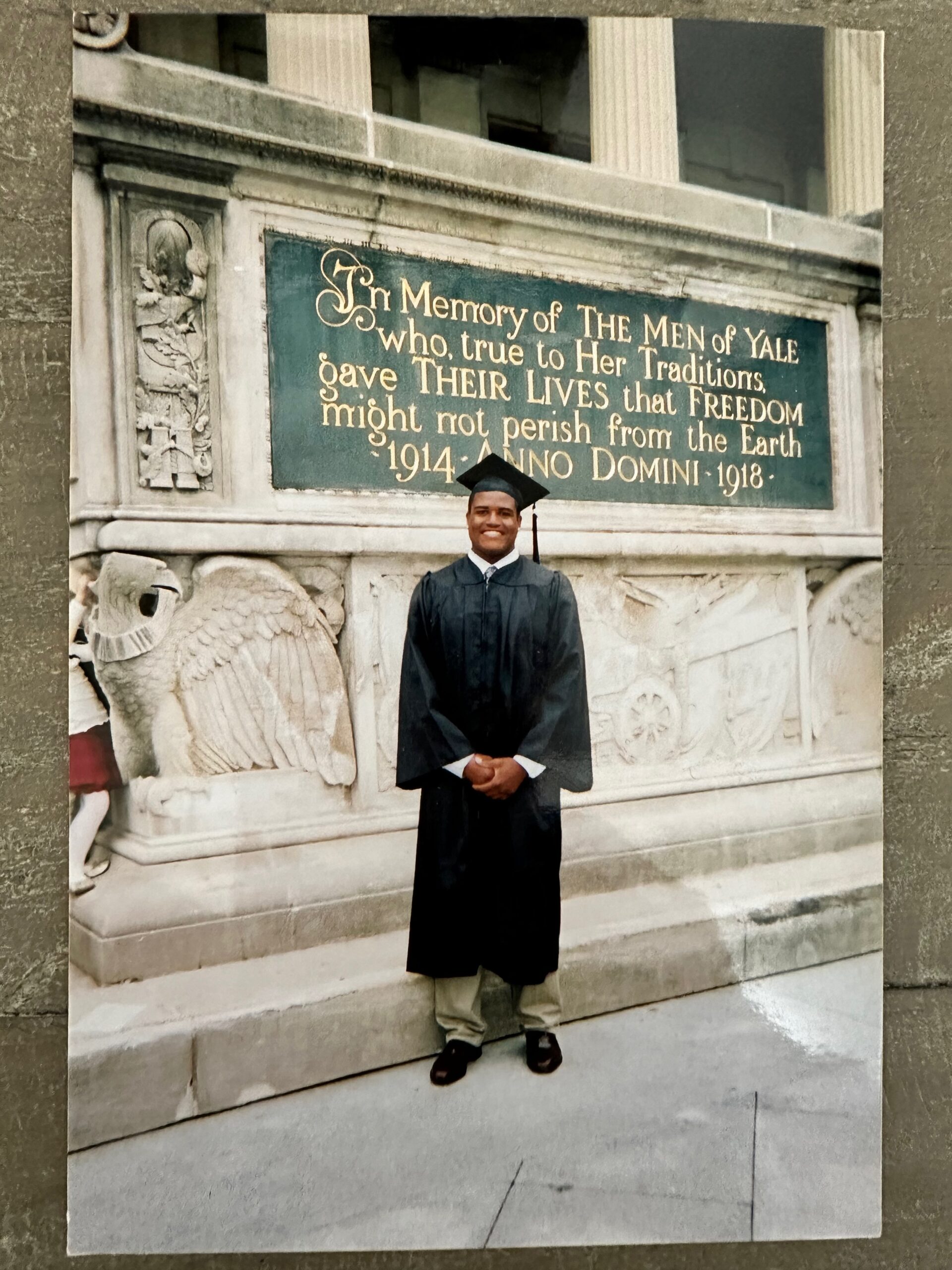

Darius graduated from Yale in 2009. Having spent his childhood in housing projects, homeless shelters, and occasionally on the streets with a first-hand view of addiction, Darius is passionate about social service. In addition to his philanthropic support of local and national organizations that support K-12 education, food insecurity, and homelessness, Darius is the co-chair of Yale Football’s 4 for 40 mentorship program, a junior board member of Domus Kids, and a patron for Sponsors for Educational Opportunity (SEO).

42 Macro is an independent research boutique focused on delivering systematic Macro Risk Management insights to institutional investors, corporations, financial advisors, and high net worth individuals.

My Story

From TRAGEDY to Triumph

From AUthority Magazine October 2023

It was 2008 and I was enjoying my senior year as an undergraduate at Yale without a strong inclination of what I wanted to do with my life. To that point, I was focused on preparing for the LSAT. I just assumed I would become a lawyer — not for any particular admiration for the field, but rather, because “lawyer” sounded like a good career. It seemed like a safe, reasonably straightforward path to making “a lot” of money, which, at the time, was whatever was enough to move my mom out of the low-income housing projects we grew up in — that is when we weren’t homeless. The CEO of a startup investment research boutique placed a full-page ad in the Yale Daily News with the headline: “We Are Hiring”.

It struck me as odd given that it was the career section of the paper. “Duh”, I thought. I didn’t understand the significance of the ad until I brought it up as a joke to my friends on the football team, many of whom were interns that summer at the top banks on Wall Street. They explained to me that financial markets were in complete turmoil and that a number of them were not “offered” to return full-time the next fall, which I learned was essentially a formality for 90+ percent of Wall Street interns. It was the first time any of them ever heard about economic conditions being bad enough for Wall Street to eschew hiring a new “analyst class”.

In fact, many of their former bosses had been laid off or were about to be in short order. It was complete chaos. Of course I — with a few hundred dollars to my name that I had accumulated from working odd jobs around campus — knew nothing about the carnage in financial markets. I knew nothing about this “financial” world. Nothing about the stock market; my parents struggled with drug and alcohol abuse my entire childhood and never had any savings to invest. I knew nothing about “investment banks”; the only banks I was aware of were the ones where people cashed their checks — if they were fortunate enough to have a bank account. At any rate, I decided to apply to the firm that had placed the ad and the rest is history.

“A life is not important except in the impact it has on other lives.”

—Jackie Robinson

RECENT Appearances

Click on the following link to review Darius’ latest media appearances.

Let’s Get In Touch